Why Financial Ratios Matter

Understanding financial health is essential for making informed decisions, whether in business or personal finance. Financial ratios serve as powerful tools to evaluate performance, manage risks, and plan for the future. However, with numerous ratios to track, a financial ratios cheat sheet simplifies the process by providing a quick and easy reference to key metrics.

The Value of a Financial Ratios Cheat Sheet

A financial ratios cheat sheet is a practical resource designed to enhance financial analysis by offering immediate access to important formulas. Its benefits include:

- Time Efficiency – Eliminates the need to search for formulas, allowing faster financial assessments.

- Improved Accuracy – Minimizes errors by keeping essential calculations in one place.

- Better Financial Decisions – Helps in evaluating profitability, liquidity, leverage, and efficiency.

- Enhanced Financial Literacy – Strengthens understanding of financial data for investors, students, and professionals.

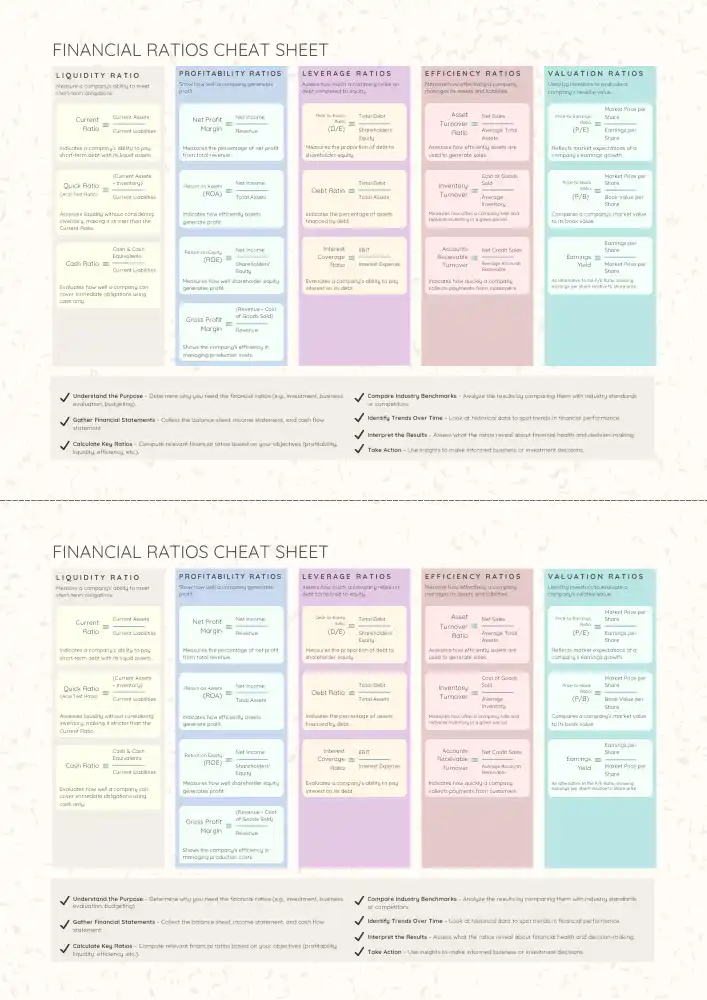

Key Financial Ratios Included in the Cheat Sheet

This cheat sheet is structured to cover critical aspects of financial performance:

- Profitability Ratios – Assess business profitability (e.g., Gross Profit Margin, Net Profit Margin, Return on Equity).

- Liquidity Ratios – Measure short-term financial stability (e.g., Current Ratio, Quick Ratio, Cash Ratio).

- Efficiency Ratios – Evaluate how effectively a company utilizes resources (e.g., Inventory Turnover, Asset Turnover).

- Leverage Ratios – Determine the extent of financial leverage and risk (e.g., Debt-to-Equity Ratio, Interest Coverage Ratio).

- Market Valuation Ratios – Help investors analyze stock performance (e.g., Price-to-Earnings Ratio, Dividend Yield).

Making the Most of Your Financial Ratios Cheat Sheet

To maximize the effectiveness of your cheat sheet, consider these best practices:

- Keep It Accessible – Print or save a digital copy for quick reference.

- Understand the Meaning Behind Each Ratio – Know how each metric reflects financial performance.

- Use Industry Comparisons – Benchmark ratios against industry standards for accurate insights.

- Monitor Financial Trends Over Time – Track changes to spot strengths and weaknesses.

- Pair It with Other Financial Tools – Combine with budget planners and forecasting models for a holistic financial strategy.

Financial Management Isn’t Just for Businesses It’s Personal Too

Financial ratios are not limited to corporate finance they can also be applied to personal financial management. By using a budget planner, individuals can monitor their income, expenses, and savings effectively. Tracking financial metrics such as savings rates and debt-to-income ratios can help create better spending habits, improve financial stability, and achieve long-term financial goals.

Why a Printable Financial Ratios Cheat Sheet is a Game-Changer

A printable cheat sheet provides a tangible way to reinforce financial knowledge. Unlike digital tools that may require internet access, a printed version is always available for quick reference. It can be used in workspaces, study materials, or financial reports, making financial analysis more efficient and accessible.

Conclusion

A financial ratios is a powerful tool for anyone looking to improve financial decision-making. Whether managing business finances or personal budgets, having a structured reference for key ratios saves time, enhances accuracy, and supports smarter financial choices. Equip yourself with the right tools and take control of your financial future today.

Leave a Reply