Why You Need a Monthly Budget Planner

Managing personal finances can feel overwhelming, especially with fluctuating expenses and unexpected costs. A monthly budget planner helps bring clarity and control to your financial situation by organizing your income, tracking expenses, and setting savings goals. By using a structured budget plan, you can reduce financial stress, avoid unnecessary spending, and work towards your financial aspirations with confidence.

The Benefits of a Monthly Budget Planner

A free template monthly budget planner offers numerous advantages for those looking to take charge of their financial health. Here are some key benefits:

- Clear Financial Overview – Organizing income, fixed expenses, and variable expenses provides a transparent picture of your financial health.

- Better Money Management – Helps track where your money is going and identify spending patterns.

- Encourages Savings – Planning ahead ensures you allocate funds for savings and financial goals.

- Prevents Overspending – Monitoring spending habits allows you to cut back on unnecessary expenses.

- Reduces Financial Stress – Knowing your finances are in order gives you peace of mind and a sense of control.

- Perfect for No-Spend Challenges – Helps you set goals for a no-spend challenge and stay accountable.

- Customizable and Printable – A printable budget planner allows flexibility to adjust it according to your needs.

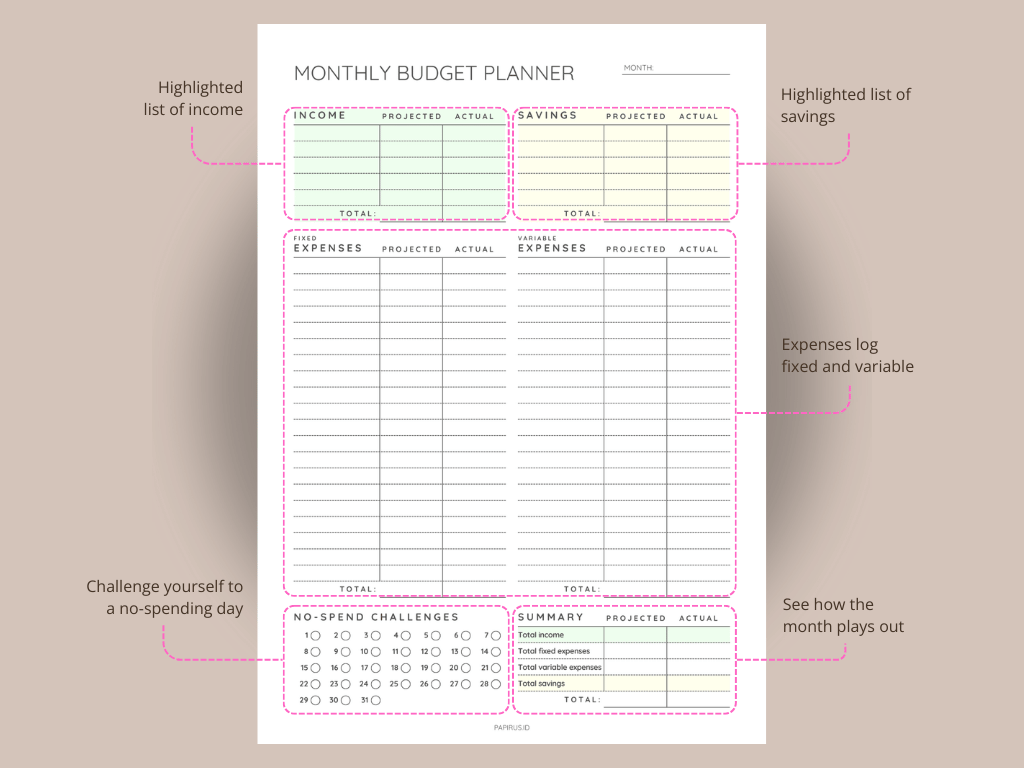

How to Use a Monthly Budget Planner Effectively

To maximize the benefits of a monthly budget planner, follow these steps:

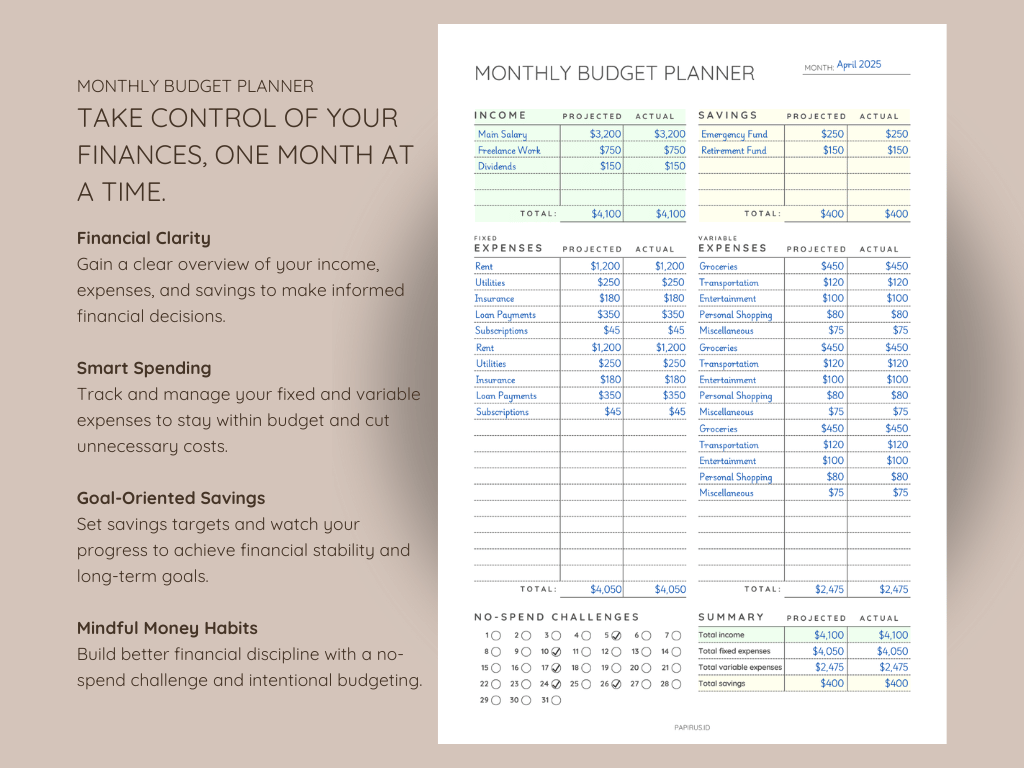

- Record Your Income – Write down all sources of income for the month to establish your starting point.

- List Fixed Expenses – Include necessary recurring payments such as rent, insurance, utilities, and loan payments.

- Track Variable Expenses – Monitor spending on groceries, transportation, entertainment, and other fluctuating costs.

- Set Savings Goals – Allocate a portion of your income to savings, whether for an emergency fund, investments, or big purchases.

- Plan for a No-Spend Challenge – Set days or weeks where you commit to spending only on essentials.

- Review Your Monthly Summary – At the end of the month, analyze spending patterns and make adjustments for the next month.

The Power of a No-Spend Challenge

A no-spend challenge is an excellent way to reset spending habits and improve financial discipline. By designating certain days or weeks to avoid non-essential purchases, you become more mindful of where your money goes. Pairing a monthly budget planner with a no-spend challenge helps you identify spending triggers, prioritize needs over wants, and build a healthier relationship with money.

Why a Printable Monthly Budget Planner is Ideal

A printable format offers an easy and effective way to stay on top of your finances. Unlike digital apps, a physical planner allows you to write down expenses manually, which can increase financial awareness. Keeping a tangible budget sheet also serves as a daily reminder to stick to your financial plan.

Additionally, a free template makes it simple to customize according to individual needs. Whether you prefer a minimalist approach or detailed tracking, a printable planner gives you the flexibility to design a budgeting system that works best for you.

How a Monthly Budget Planner Complements a Weekly Review Planner

A weekly review planner plays a crucial role in ensuring financial accountability. While a monthly budget planner provides a broad financial overview, reviewing your budget weekly helps keep spending in check before the month ends. By consistently analyzing your budget on a smaller scale, you can adjust expenses, avoid financial pitfalls, and stay on track toward your goals.

Final Thoughts

A monthly budget planner is an essential tool for gaining financial control and making informed money decisions. Whether you’re saving for a major purchase, eliminating debt, or simply striving for better financial habits, a structured budgeting plan can help you reach your goals. Pairing it with a free template makes the process even more accessible, allowing you to personalize and adjust your budget as needed. By incorporating a printable budget planner into your routine, you can take a proactive approach to managing your finances and achieving long-term financial stability.

If you need a free printable template, you can download our planner below, or if you’d like to support us, you can purchase it on Etsy through the link below.

Leave a Reply